One of the peculiar ways to deal with the problem of unpaid debt in 17th-century Western Europe was to throw delinquents into a debtors’ prison. Incarceration was the last stage in the rather vicious process of debt collection that began by ‘dunning’ i.e. forcibly demanding repayment of a debt.

Today, the word ‘dun’ has come to mean ‘to pester’ or ‘to plague’. Dunning has a bad reputation, and rightly so. It’s invasive, intimidating, and inhuman. Even in our modern world, eCommerce companies have in the past been guilty of ‘pestering’ their customers to update their payment/billing details.

In an age that is fortunately turning to empathizing with, and creating real value for, customers, pestering or hounding is no longer an alternative. In this blog post, we’ll share how to write, design, and send out dunning emails that actually work.

What Is A Dunning Email?

A dunning email is a transactional email sent to subscribers reminding them of their due payments.

Customer churn is singularly responsible for necessitating dunning. According to HubSpot, in the SaaS industry, companies focusing on small-to-medium businesses witness a 3-5% monthly churn rate.

Worse, for new SaaS companies, the number shoots up to 15% per month, at least during their maiden year on the market.

A churn may be voluntary or involuntary. An involuntary churn occurs when a customer has a payment failure, leading to automatic subscription cancellation.

Involuntary churns may happen for a number of reasons, such as when the customer has lost their credit card, has got a new credit card, or has exceeded their card limit. It may also happen if there are bottlenecks in the network of the banking system.

Hence the need for dunning management. The right dunning strategy:

- Reduces involuntary churn

- Maintains revenue stability

- Saves time

- Enhances customer experience

We shall deal with each of these in more detail later in the post. But first, let’s see how to write, design, and send a dunning email.

Writing A Dunning Email

Like any email copy, a dunning email will have three components: subject line, email body, and conclusion.

Your subject line must be short, and to the point. Generally speaking, because it’s transactional, dunning email subject lines don’t always have to be creative. Usually, where anything related to money is involved, the driest phrases often click.

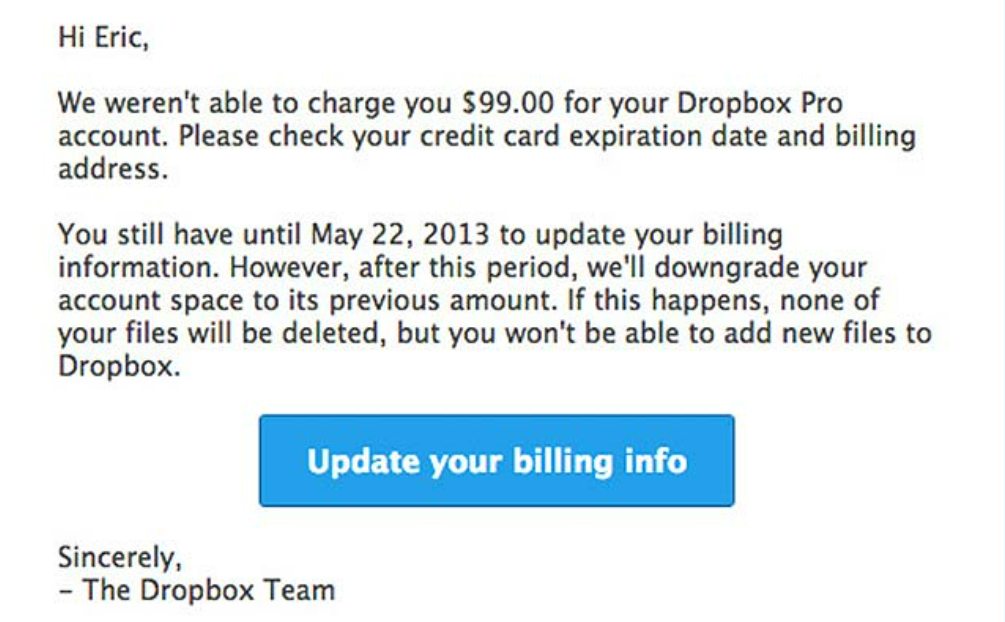

Take the following subject line from a Dropbox dunning email.

It can be as straightforward as that. While your email may be just one of many such emails crowding the subscriber’s inbox, simple subject lines still work.

Coming to the email body, you want to make your copy direct, informative, and empathetic. While it’s a transactional email, avoid using too formal a tone. The same email by Dropbox is too formal, and rather crudely injunctive.

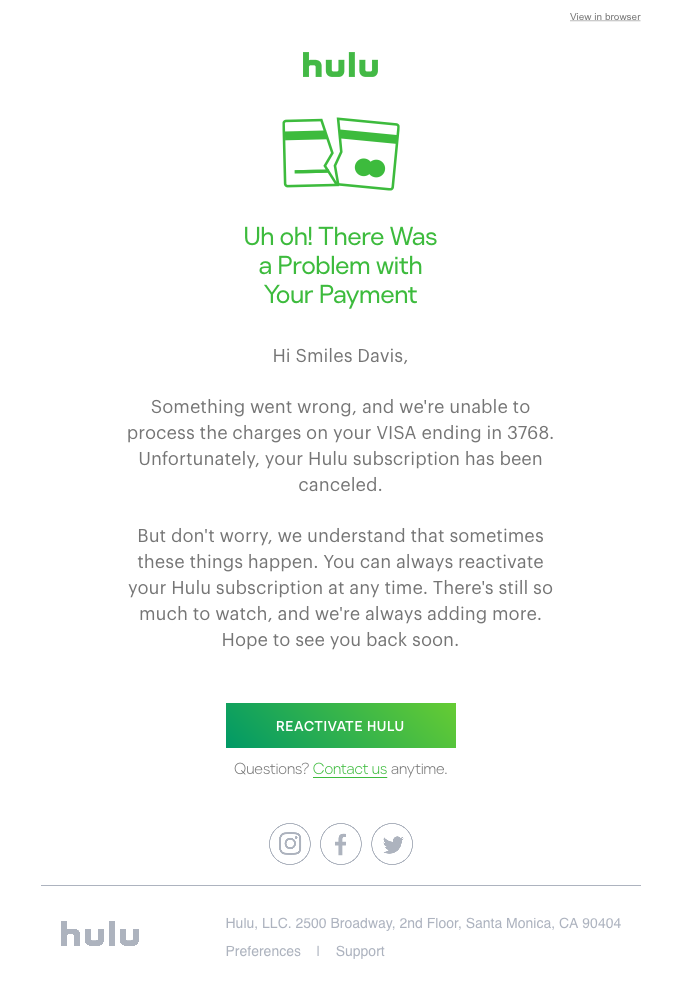

Compare it with the following dunning email from Hulu.

Do you see the difference? Hulu’s copy is appropriately informal, friendly, and reassuring. Phrases like ‘Don’t worry’, ‘We understand’, ‘These things happen’ etc. are always effective in dunning emails.

Notably, the way the email starts — ‘Something went wrong…’ — is interesting, and really nails the point home. The ambiguity effectively dismantles any preconceived notion of who has the so-called upper hand in the exchange. Can it get more anti-dunning?

It’s also a fine example of context sharing, one of the hallmarks of personalized marketing.

Finally, closing a dunning email also requires some consideration. Take a look at how Hulu closes the same email.

There is the obvious call to action, but below the button, the smaller CTA provides an alternative. Often, the customer is not in control of their payment issues. In those cases, closing the way Hulu has done is always helpful, and leads to a positive customer experience.

Designing A Dunning Email

The purpose of a dunning email is primarily to inform in order to make the customer act in a desired way. As a result, most dunning email templates are simply designed, and rich in white space.

You don’t want anything in your email that may cause distraction. Design is only useful as a framework, nothing more. Check out the following pre-dunning email from Slack.

As you can see, there are no images, no distractions, just the necessary information, and the brand logo.

Similarly, consider The Noun Project’s pre-dunning template below. The email does not have a text-rich body, but it is amply white-spaced to keep the focus on the information.

Sending A Dunning Email

More often than not, customers don’t act after just one dunning email. So, create a sequence of four-five dunning emails, each time tailoring the message according to the time lapsed.

The first email is a pre-dunning email, like the above two emails from Slack and The Noun project. It’s a cautionary reminder.

The second email is where the subscriber is reminded about having to renew their subscription.

The third email is a final notice to the subscriber, asking them to update their payment/billing information.

The fourth email is the Last Chance notification, informing the recipient that their subscription will be canceled in so many days.

Now, set a sending schedule to automate the send-outs. Ideally, you should send a dunning email once every four or five days.

Benefits Of Implementing Dunning Emails

Having looked at the general dunning email best practices, let us now consider the benefits of dunning emails in some detail.

1. Reduces Involuntary Churn

As we mentioned before, involuntary churn happens when the customer doesn’t actually want to cancel their subscription, but due to unforeseen payment issues, is automatically blocked out of their account.

So the customer wants to stay subscribed, but cannot. Without proper dunning management, you end up losing thousands of dollars for nothing.

The best way to reduce involuntary churn is to use payment processors to effectively monitor transactions, and alert customers as soon as there is a problem.

2. Maintains Revenue Stability

By sending automated alerts to customers so that they have the time to update their billing information and pay up, you can maintain a stable revenue stream.

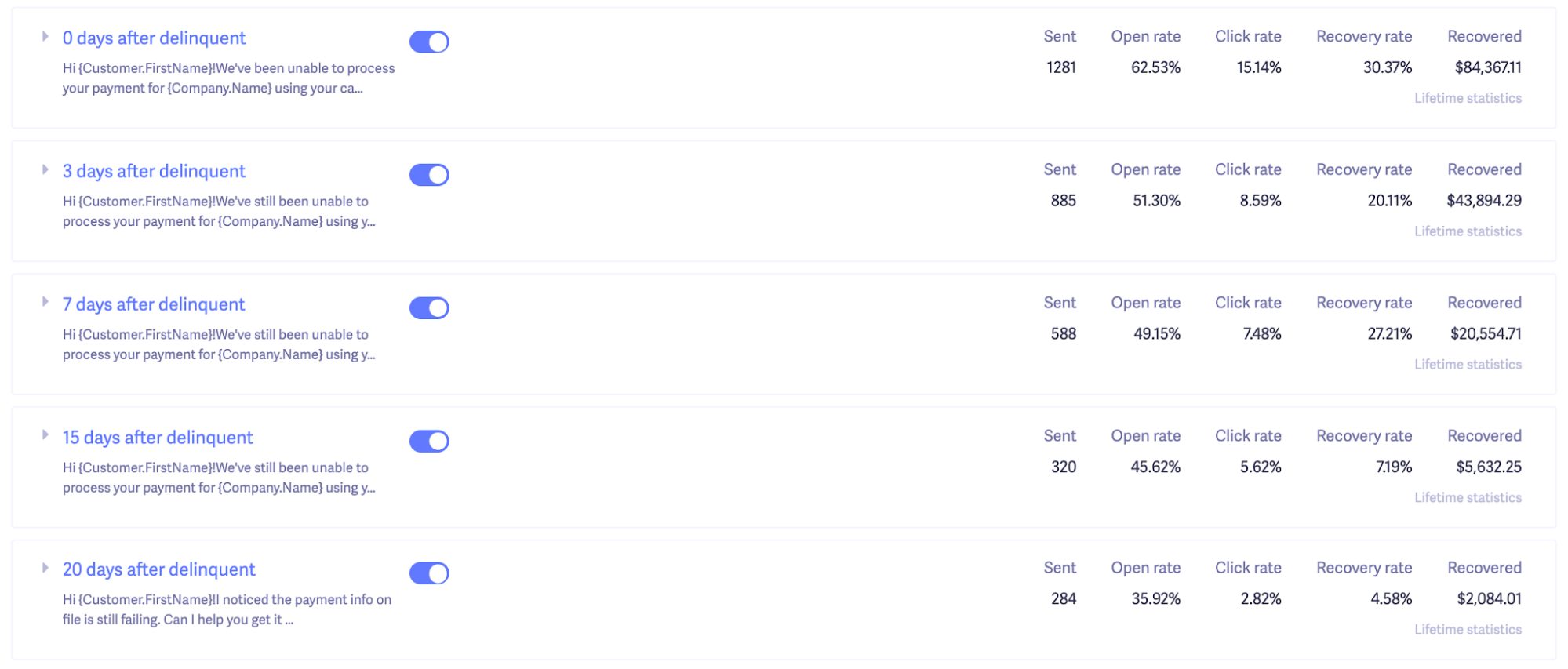

The point is to keep sending reminders at specific intervals. Here’s a brilliant example of revenue recovery by Baremetrics.

As you can see, Baremetrics set up a 20-day dunning cycle. Here’s what’s fascinating: they were able to recover a whopping $84,367.11 upon sending just one notification. The recovery rate at Day 0 stands at 30.37%. That’s how effective proactive dunning can be.

3. Saves Time

Manual dunning management is time-taking. You’re not dealing with one or two customers. Also, you’re prone to making mistakes. Sending a dunning email to paying customers is embarrassing, to put it mildly.

Automated dunning management saves time and resources. You can easily integrate a dunning management software into your ESP, and maximize promptness, and accuracy.

Need help with email automation? Get in touch!

4. Enhances Customer Experience

The point of sticking to dunning email best practices is ultimately to deliver positive customer experiences.

Of course, no one gave a damn in the 17th century about how debtors felt when creditors came banging on their doors. But in the 21st century, even so maligned a practice as dunning can be changed into a positive experience.

Instead of sending generic email blasts, you want to send personalized dunning emails to your customers. You don’t want to sound invasive, or intimidating. As we’ve been seeing in this post, from subject line to body to conclusion, a dunning email can be as civil as you want it to be.

Wrapping Up!

Dunning is no more only about getting delinquents to pay up. With the help of a foolproof dunning strategy, businesses can afford to make their customers smile in the midst of a payment crisis.

Susmit Panda

Latest posts by Susmit Panda (see all)

8 Bewitching Halloween Email Inspirations That Will Make You Scream in Delight!

Designing Pitch-perfect Landing Pages with Pardot- All You Need To Know!